Company News & Industry Insights

NEWS

Horion won the 2019 Most Famous Brand in the Interactive Flat Panel Market

Abstract:On December 4, the Shenzhen International SmartVision Expo (ISVE) kicked off at the Shenzhen Convention and Exhibition Center. On December 4, the Shenzhen International SmartVision Expo (ISVE) kicked off at

Horion debuting M4 at 21st China Hi-Tech Fair

Abstract:The China Hi-Tech Fair (CHTF), known as "China's No. 1 Technology Show", will take place at the Shenzhen Convention and Exhibition Center during November 13-17. The China Hi-Tech Fair (CHTF),

Horion interactive flat panel is attending the InfoComm India Exhibition

Abstract:InfoComm India 2019 will be held from September 18th to September 20th at the Bombay Convention and Exhibition Centre. Horion's Overseas Business Unit will take the overseas version super

What will the corporate conference look like in the 5G era

Abstract:Recently, the Ministry of Industry and Information Technology (MIIT) officially issued 5G commercial licenses to China Telecom, China Mobile, China Unicom. Recently, the Ministry of Industry and Information Technology

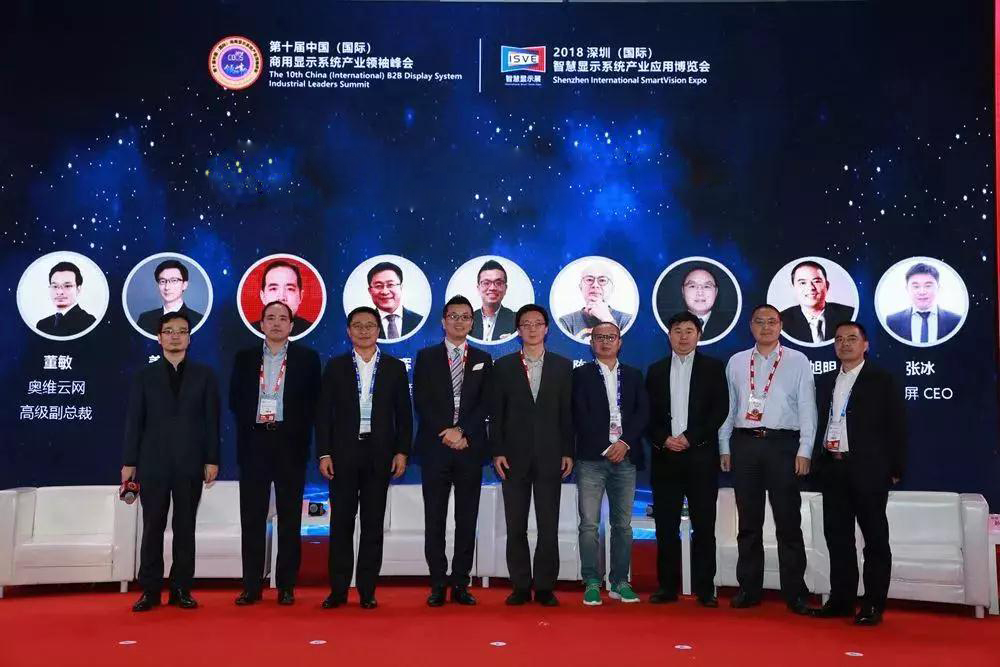

Horion won the “Most Famous Brand” in the Interactive Flat Panel Market

Abstract:The General Manager of Horion was invited to participate in the ribbon-cutting ceremony of the Leaders Summit and to discuss the development of the industry. The General Manager of

Agents worldwide are wanted to join us to explore the interactive panel market

Abstract:In response to the rocketing demand from global market for the interactive flat panel, Horion decides to open up this opportunity to agents worldwide. In response to the rocketing

M3, wonderful performance stages across three cities

Abstract:May 21st, “Beyond the Appearance”, the Horion M3 New Product Release and Channel Promotion Conference was veiled simultaneously in Beijing, Zhengzhou and Kunming. May 21st, “Beyond the Appearance”, the

Why enterprises favor Horion interactive flat panel in the capital winter?

Abstract:Faced with this capital winter, Didi Chuxing and Jingdong have to downsize, and a large number of Internet companies start to work together. Faced with this capital winter, Didi

Horion debuts in “The Second Italy -Greater Bay Area Innovation Road”

Abstract:On January 17, the Second Italy -Greater Bay Area Innovation Road, jointly organized by Deloitte (China), Intesa Sanpaolo and Tianan Junye, was held in Tianan Yungu. On January 17,

Horion received “Innovative Enterprise Award”and“The Good Product of Shenzhen”

Abstract:On the afternoon of January 15, the Shenzhen Computer Industry Summit Forum and Commendation Conference was held in Shenzhen Science Park International Conference Center. On the afternoon of January

Three style UI of Horion, chose freely as you like

Abstract:Since the launch of the high-end new UI in the commercial version in October, it has caused widespread concern and response. Since the launch of the high-end new UI

Sailing the international market, Horion reoccupies the highlands

Abstract:Due to the increasing demand in the international market, Horion will enter the international market. Due to the increasing demand in the international market, Horion will enter the international